Renters Insurance in and around Brooklyn

Get renters insurance in Brooklyn

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Brooklyn

- New York

- New Jersey

- New York City

- Queens County

- Kings County

- Manhattan

- Staten Island

- Sussex

- Newark

- Bronx County

- Park Slope

- Rego Park

- Bedford Stuyvesant

- Flatbush

- Boerum Hill

- Brooklyn Heights

- Cobble Hill

- Clinton Hill

- Prospect Heights

- Carroll Gardens

- Crown Heights

- East New York

- Red Hook

Insure What You Own While You Lease A Home

There's a lot to think about when it comes to renting a home - furnishings, utilities, outdoor living space, apartment or house? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Get renters insurance in Brooklyn

Renters insurance can help protect your belongings

Safeguard Your Personal Assets

The unanticipated happens. Unfortunately, the personal belongings in your rented home, such as a coffee maker, a TV and a set of favorite books, aren't immune to burglary or fire. Your good neighbor, agent Alan Wheeler, is passionate about helping you examine your needs and find the right insurance options to protect your personal posessions.

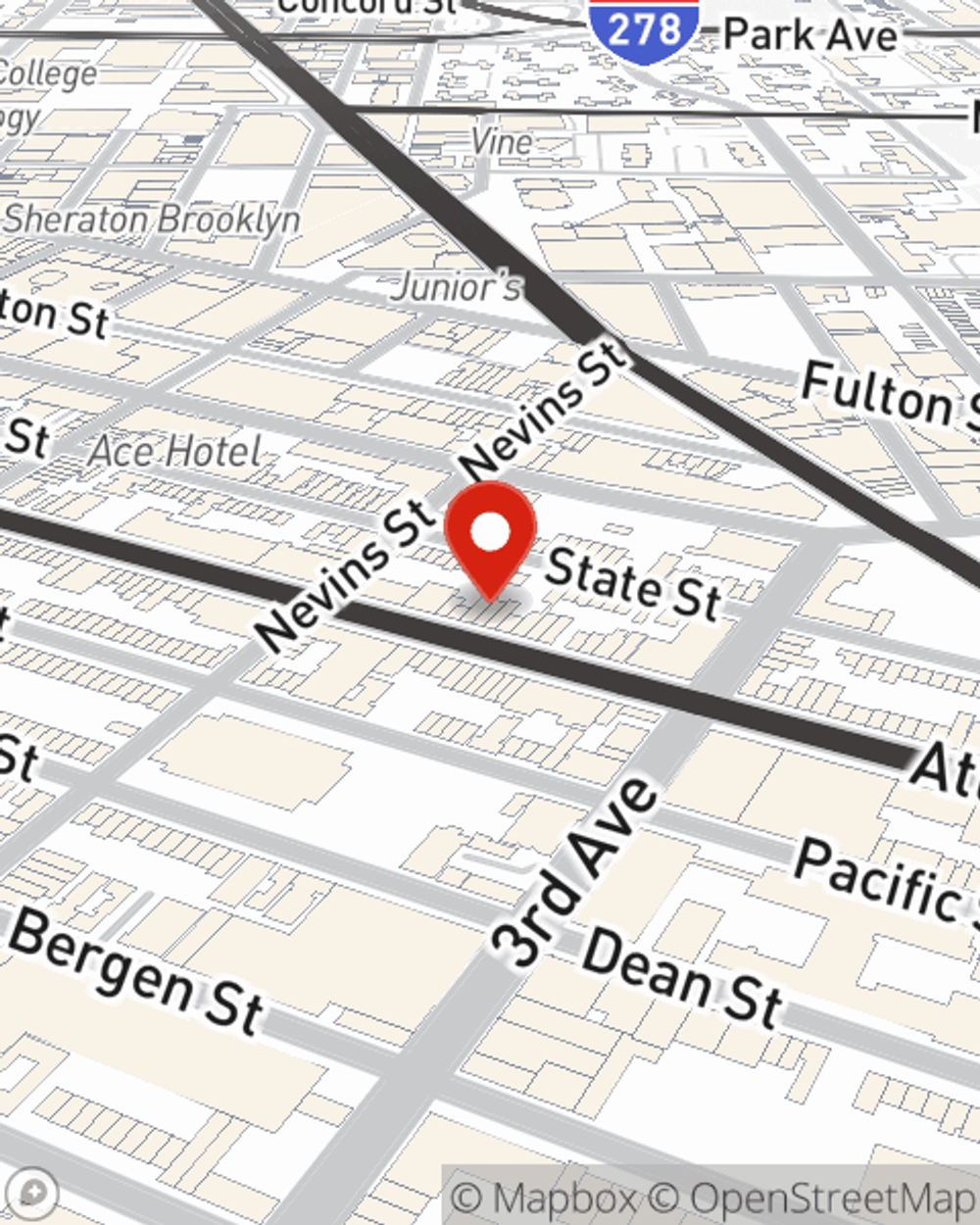

Contact State Farm Agent Alan Wheeler today to find out how a State Farm policy can protect items in your home here in Brooklyn, NY.

Have More Questions About Renters Insurance?

Call Alan at (718) 488-7300 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Alan Wheeler

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.